charitable gift annuity calculator

Our Gift Planning department has a representative in your area who can provide further information or help you prepare the right questions to ask your financial advisor to determine. Need help calculating expected income from a charitable gift annuity.

Charitable Gift Annuities Philadelphia Foundation

Your calculation above is an estimate and is for illustrative purposes only.

. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Charitable Gift Annuity Calculator. Calculate deductions tax savings and other benefitsinstantly.

Use our gift calculator to get a quick estimate on how your annuity payments and tax deductions may look by entering a specific gift amount you may want to consider. Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West. The calculator below determines the charitable deduction for any of the following gift types.

It does not constitute legal or tax. Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. Your calculation above is an estimate and is for illustrative purposes only.

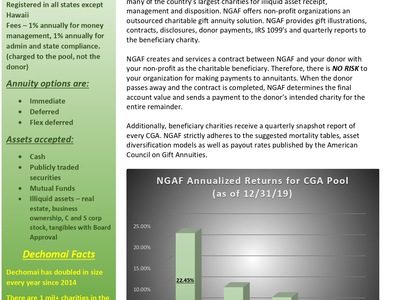

Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and. Complimentary Planning Resources Are Just a Click. Rates for a Charitable Gift Annuity funded July 1 2022 or later.

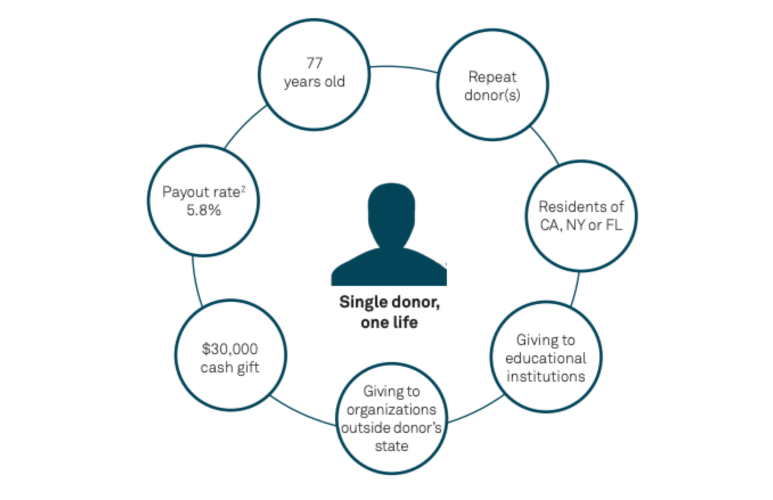

Please click the button below to open the calculator. Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight heart. Income rates are based on your age or the age of your beneficiary at the time payments commence.

Email protected Our Sites. Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. Deferred Charitable Gift Annuity Calculator.

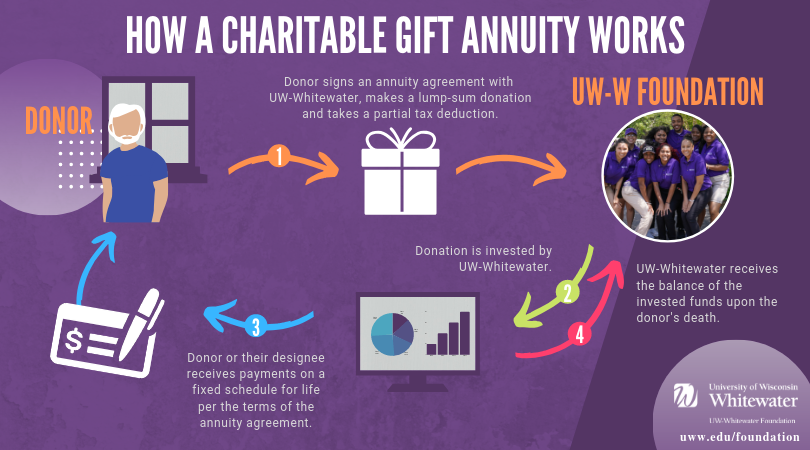

The National Gift Annuity Foundation offers immediate deferred and flexible gift annuity structures allowing you to meet your lifetime income payment needs. Ways to Gift. Our recent analysis revealed that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in April June 2021 for females at ages 46 through.

Use our handy Gift Calculator. Wills Trusts and Annuities Home Why Leave a Gift. Use this free no-obligation tool to find the charitable gift thats right for you.

615 Chestnut St 17th Floor Philadelphia PA 19106-4404 USA Telephone. Rates for a Charitable Gift Annuity funded July 1 2018 or later. Calculate the benefits of a.

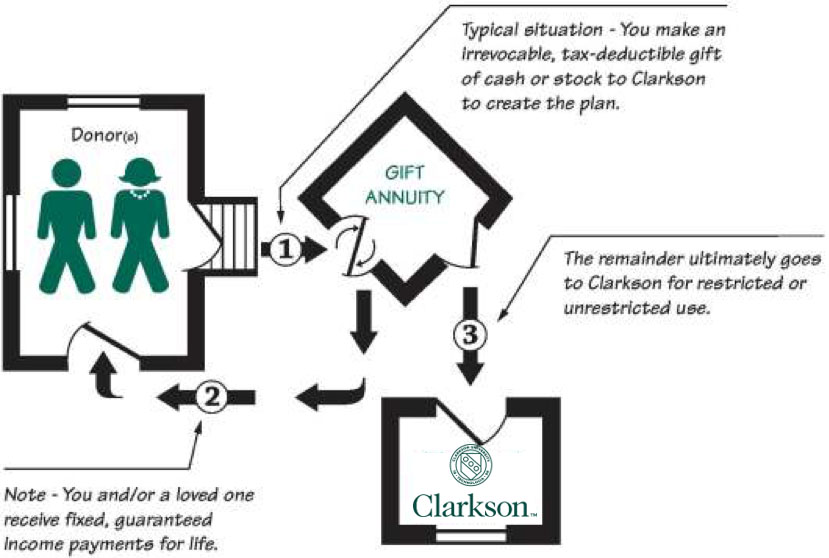

Simply input the amount of your possible gift the basis of the property. By making a charitable gift annuity you can provide much-needed funds for conservation and provide yourself with a stable income. It does not constitute legal or tax.

Thanks to Lifesaving Cancer Research 18000000 cancer survivors in the United States are living with through and beyond their disease. By pooling these life. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a.

Charitable Gift Annuity Calculator.

Gift Calculator Harvard Medical School

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving

Charitable Gift Annuities Giving To Duke

Planned Giving National Park Foundation

Gifts That Pay You Income The Salvation Army Western Territory Arc

Giftlegacy Presents Calculator Main Page Thunderbird School Of Global Management

Create Fixed Income Now Charitable Gift Annuity Gift Planning Bentley University

Former Library Head Pioneers New Way To Give At Ut Dallas News Center The University Of Texas At Dallas

What Is A Charitable Gift Annuity And How Does It Work 2022

Uja Federation Of New York Planned Giving Charitable Gift Annuity

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuities Making A Rebound The Nonprofit Times

Charitable Gift Annuity Calculator Jewish Federation Of Metropolitan Detroit